VC pioneer offers insights on building entrepreneurial ecosystem

How do you build a sustainable ecosystem for entrepreneurs?

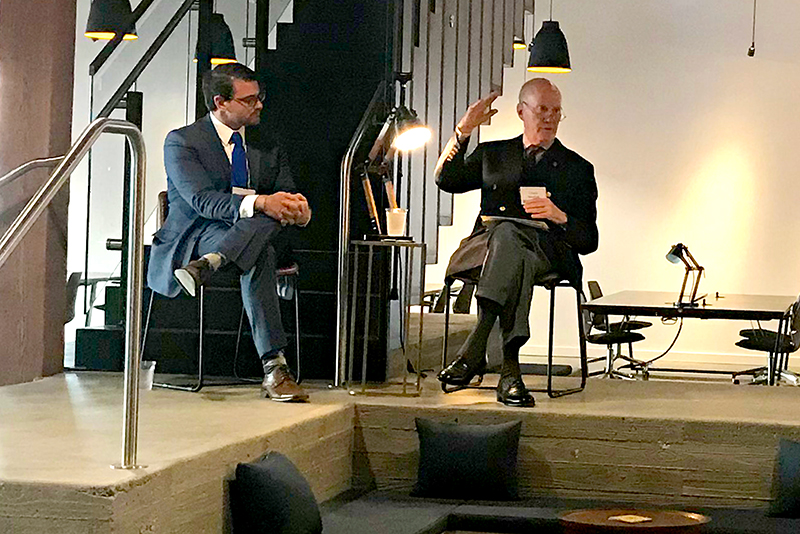

In a talk hosted by the Freeman School’s Albert Lepage Center for Entrepreneurship and Innovation on Sept. 19, venture capital giant Chuck Newhall invoked an analogy tailor-made for his Louisiana audience.

“How many of you are duck hunters?” asked Newhall, co-founder of venture firm New Enterprise Associates and chairman emeritus of the Mid-Atlantic Venture Association. “The secret of creating an entrepreneurial landscape is ducks on a pond.”

Like birds of a feather, Newhall said entrepreneurs tend to gravitate toward regions with other entrepreneurial companies. The reason, he said, is easy enough to understand.

“If I start a company in Parkersburg, West Virginia, and it goes wrong, I have to move my family to another state, probably [go into] another industry, and it will be really unpleasant,” he said. “But if I’m in San Francisco and my company goes bankrupt, I walk 200 yards down the street and I have another job by the end of the day. So the prevalence of these entrepreneurial companies is crucial.”

Newhall is something of an expert when it comes to creating entrepreneurial landscapes. He founded the Mid-Atlantic Venture Association in 1986 to help create startups in the five-state region around his home base of Baltimore. The mid-Atlantic had historically been barely a blip on the national scene, accounting for less than one percent of all U.S. venture-backed IPOs. By the time Newhall stepped down in 1999, the region had received nearly $50 billion in new venture capital investments and accounted for 20 percent of U.S. venture-backed IPOs.

In a conversation with Lepage Center Executive Director Rob Lalka, Newhall said Louisiana can't achieve that level of success on its own. To bring entrepreneurs and serious investors to the region, Newhall said the state would would most likely need to partner with Texas, Mississippi, Alabama, Florida and Georgia to acquire sufficient resources.

“Then you have to identify top expansion venture capital firms in the region and get them to buy into this,” he said. “And then you’ve got to work with service providers to your entrepreneurs and get a lot of people to share a common vision.

“And be prepared,” he added. “It’s going to take 20 years or longer. Nothing happens quickly when you’re building companies.”

Lalka said Newhall’s talk was the first in a series of discussions the Lepage Center plans to present to serve the needs of the local entrepreneurial community.

“This was the first event we’ve hosted since I joined Tulane in July, and what a way to start,” Lalka said. “It was an honor to welcome one of the founding fathers of venture capital to New Orleans and introduce him to what we are building here. We’re excited that this is just the beginning, because there’s clearly interest in these kinds of events from the Tulane community and the broader entrepreneurial ecosystem.”

“Chuck is truly an exemplar in the industry," added Freeman School Dean Ira Solomon. “Hearing his thoughts on what we as a community can do to build a more sustainable entrepreneurial community was a special privilege indeed.”

Newhall's presentation took place in the Shop at the CAC, a new co-working space targeting technology, arts and cultural-based businesses. The space is the latest development of the Domain Cos., which is led by Freeman School alums Matt Schwartz (BSM ’99) and Chris Papamichael (BSM ’96).