Fox8: Many families to receive significant tax breaks per child 17-years-old and younger

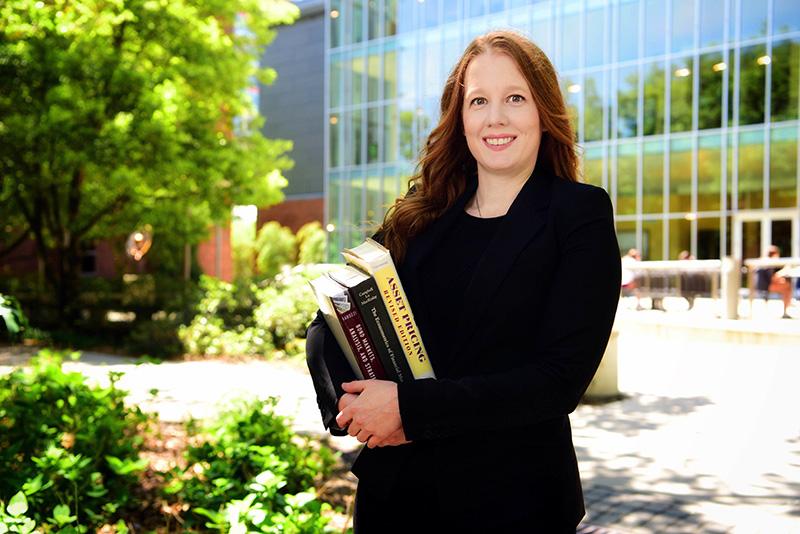

Amanda Heitz, assistant professor of finance, was interview by WVUE Fox8 for a story about the impact of President Biden's American Rescue Plan on families with children. The new law increases the tax break for families with children to $3,000 for every child ages 6 to 17 and $3,600 for every child under the age of 6.

“As long as you file your taxes, even if it’s a couple hundred, you’ll be capable of receiving this rebate… previously if you didn’t file or didn’t have enough income to receive the tax credit, you’d be out of luck, and if you think of who this impacts the most, it’s the lowest income that need it the most,” said Heitz.

To read the article in its entirety, visit fox8live.com:

Interested in advancing your education and/or career? Learn more about Freeman’s wide range of graduate and undergraduate programs. Find the right program for you.

Other Related Articles

- Alumna recalls trailblazing career in business, ministry

- DW News: Can the Fed stay independent under Trump?

- Fast Company: Are we in a K-shaped economy? Delayed employment numbers could reveal recession odds

- Newsweek: The Real Cost of Layoffs Isn’t In the Financials

- Conference explores opportunities in alternative investments

- CNN: Stocks rise ahead of tech earnings as Nvidia hits $5 trillion valuation

- Business Insider: Why a professor of finance isn't impressed by gold's stunning rally in 2025

- Alum launches fund to invest in Tulane-affiliated startups