The cost of political uncertainty

One candidate promises historic tax cuts while the other pledges to eliminate corporate loopholes. One promises to expand oil and gas production while the other vows to reduce the nation’s reliance on fossil fuels by almost half.

With a host of economic policies and regulations hanging in the balance, it’s easy to see why firms might postpone making investment decisions until after the upcoming presidential election. Scholars have long suspected that political uncertainty has a negative effect on the economy, but to date there’s been little empirical evidence to support that conclusion.

Now, new research from a professor at Tulane University’s A. B. Freeman School of Business offers the first hard data on the economic cost of political uncertainty.

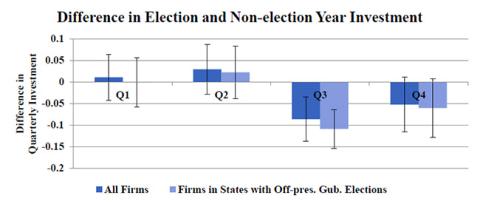

In a study of U.S. firm capital expenditure investments from 1984 to 2008, Assistant Professor of Finance Candace Jens finds that firms reduce their capital expenditures by an average of 5 percent prior to gubernatorial elections in their home states. If a race is close, those investments can drop by as much as 15 percent. Based on the 8,200 firms in her sample, that amounts to nearly $108 billion in deferred investments.

“It really boils down to an options story,” Jens says. “If you’re a CEO and you could invest in Project A or Project B or you could wait, the value of waiting is much higher right before an election because of the uncertainty.”

Jens focused her research on gubernatorial elections, which occur in at least two states every year, to remove the influence of non-political factors such as business cycles or global events, but she says her findings apply equally as well to presidential elections.

“Absolutely I think we could be seeing a partial slowdown in the economy because of political uncertainty associated with the presidential election,” she says.

While capital investments typically rebound in the quarters following elections, making up for most – but not all – of the reduction, Jens says the effect of that deferred investment on the economy is still substantial.

“If the firm isn’t starting a project for six months, that means your welders, pipefitters, electricians, plumbers, people who hang drywall — anyone in the construction industry — they’re not going to have work for six months,” Jens says. “It’s hard to put a number on [the cost of] that delay.”

While the U.S. isn’t likely to do away with elections, Jens says officials have the power to address other causes of political uncertainty.

“Any time Congress passes tax laws that are due to expire and they might or might not extend them, that’s political uncertainty,” she says. “Any type of debt ceiling debate, that creates political uncertainty. We’re not going to get rid of elections, but we could certainly do things in this country to mitigate political uncertainty from other sources.”

Jens’ paper, “Political Uncertainty and Investment: Causal Evidence from U.S. Gubernatorial Elections,” is forthcoming in the Journal of Financial Economics.

Interested in advancing your education and/or career? Learn more about Freeman’s wide range of graduate and undergraduate programs. Find the right program for you.

Other Related Articles

- De Franco appointed Keehn Berry Chair of Banking and Finance

- The Wall Street Journal: For Trump, the Warner Megadeal Talks Are All About CNN

- Research Notes: Matthew Higgins

- Fast Company: Are we in a K-shaped economy? Delayed employment numbers could reveal recession odds

- New Goldring Institute director hopes to expand international partnerships

- New study shows how personal profiles transform social media customer service

- Research Notes: Shuhua Sun

- Newsweek: The Real Cost of Layoffs Isn’t In the Financials