Finance

-

| Research

| ResearchXuhui “Nick” Pan's paper “Oil Volatility Risk and Expected Stock Returns” has been accepted for publication in the Journal of Banking and Finance.

-

| Research

| ResearchNishad Kapadia and Morad Zekhnini’s paper “Getting Paid to Hedge: Why Don't Investors Pay a Premium to Hedge Downturns?” has been accepted for publication in the Journal of Financial and Quantitative Analysis.

-

| Research

| ResearchOleg Gredil’s paper “Do Private Equity Funds Manipulate Reported Returns?”, co-authored with Gregory W. Brown and Steven N. Kaplan, has been accepted for publication in the Journal of Financial Economics.

-

| Research

| ResearchRobert Prilmeier’s paper “Why Does Fast Loan Growth Predict Poor Performance for Banks?”, co-authored with Rüdiger Fahlenbrach and René Stulz, has been accepted for publication in the Review of Financial Studies.

-

Marshall Wadleigh’s story of accomplishment is a testament that hard work breeds success. The Tulane University senior from Pearl River, Louisiana, maintained a 4.0 grade point average as a walk-on member of the Tulane football program…

-

Freeman students Jodi Gottlieb, Audrey Preston, Brooke Satterfield and Cara Williamson took home first place honors in the second annual Aaron Selber Jr. Course in Alternative Investments Distressed Debt Investment Pitch Competition.…

-

A team of Master of Finance students from Tulane University’s A. B. Freeman School of Business won first place at the TIPS 2017 Student Portfolio Managers Competition.

-

Based on its performance since 2001, Thomson Reuters Lipper ranked the Hancock Horizon Burkenroad Small Cap Fund No. 1 in the small cap blended category.

-

| Research

| ResearchTed Fee’s paper “Playing Favorites? Industry Expert Directors in Diversified Firms,” co-authored with Jesse Ellis and Shawn Thomas, has been accepted for publication in the Journal of Financial and Quantitative Analysis.

-

A team of Master of Finance students from Tulane University’s A. B. Freeman School of Business earned second-place honors in the 2016 ACG Louisiana Energy Case Competition.

-

Can unethical behavior at the individual level predict wrongdoing at the corporate level? That’s a question William Grieser, assistant professor of finance at Tulane University’s A. B. Freeman School of Business, sought to answer with…

-

William Donius (BSM '81)Business executive and author William A. Donius (BSM ’81) visits Tulane this week for a special lecture and workshop sponsored by the Lepage Center for Entrepreneurship and Innovation. Donius is the author of…

-

| Research

| ResearchNew research from a professor at Tulane University’s A. B. Freeman School of Business offers the first hard data on the economic cost of political uncertainty.

-

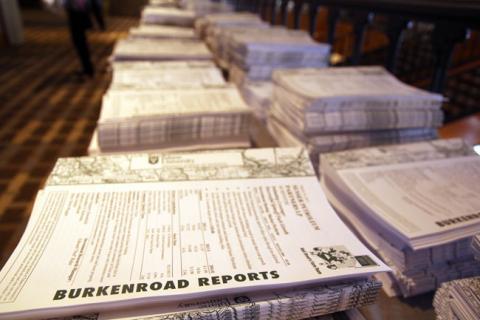

Beginning in January, users of S&P Capital IQ will be able to access Burkenroad Reports, the Freeman School's acclaimed equity research program.S&P Global Market Intelligence, a leading provider of research, data and analytics…

-

| Research

| ResearchZeigham Khokher’s paper “The Information Content of a Nonlinear Macro-Finance Model for Commodity Prices,” co-authored with Timothy Simin of Pennsylvania State University and Saqib Khan of the University of Regina, has been accepted…

-

| Research

| ResearchVenkat Subramaniam's paper "Impact of Financial Leverage on the Incidence and Severity of Product Failures: Evidence from Product Recalls" has been accepted for publication in The Review of Financial Studies. The paper was co-…

-

Elliot Davis, coordinator of research with AACSB International, highlighted the Freeman School's Burkenroad Reports program in a recent blog posting about experiential learning in finance programs. Davis praised the program, which is…

-

On Thursday (May 12), the Freeman School's David Lesmond, associate professor of finance, spoke with Garland Robinette, host of WWL-AM's Think Tank, about hedge fund manager salaries. There are 11,000 hedge funds and I would venture to…

-

| Research

| ResearchRobert Prilmeier’s paper “Why Do Loans Contain Covenants? Evidence from Lending Relationships” has been accepted for publication in the Journal of Financial Economics. In addition, his paper “Why Does Fast Loan Growth Predict Poor…

-

An MBA team representing Tulane University's A. B. Freeman School of Business earned second-place honors in the 20th annual Rolanette and Berdon Lawrence Finance Case Competition.MBA teams from Washington University in St. Louis,…

-

| Research

| ResearchNishad Kapadia's article "Davids, Goliaths, and Business Cycles," co-authored with Jefferson Duarte, associate professor of finance at Rice University's Jones Graduate School of Business, has been accepted for publication in Journal of…

-

| Research

| ResearchCandace Jens' paper “Political uncertainty and investment: casual evidence from U.S. gubernatorial elections” has been accepted for publication in the Journal of Financial Economics. Jens is an assistant professor of finance at the A.…

-

If you’ve ever seen the reality show “Shark Tank,” you know the format: Budding entrepreneurs pitch their ideas to a panel of investors with thousands of dollars in funding resting in the balance. Alberta Wright, above, a teacher at…

-

| Research

| ResearchLingling Wang's paper “Executive Compensation Incentives Contingent on Long-term Accounting Performance,” co-authored with Zhi Li, has been accepted for publication in the Review of Financial Studies. Wang is an assistant professor of…

-

When Peter Ricchiuti speaks at conventions and corporate meetings, event organizers bill him as “the financial professor you wish you’d had in college.” Peter Ricchiuti took alumni and parents on a whirlwind and lighthearted…